The Dominant Mid-

The mid-

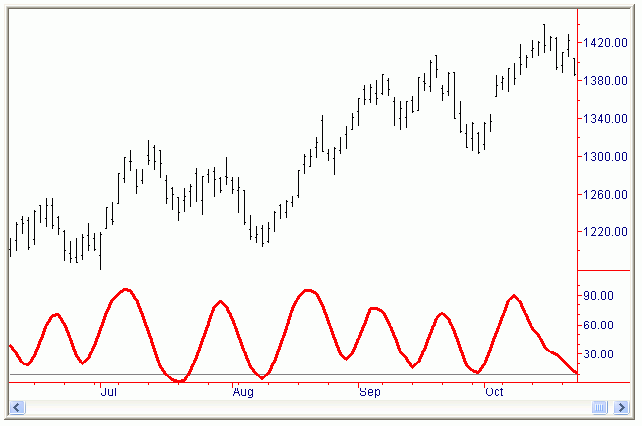

If the trend of the market is strongly UP (as it was throughout much of the chart

above), then the oscillator will usually turn before price at cycle tops. This is

not a 100% rule, but it occurs more often than not. In other words, if the market

is in a strong uptrend, then it does not pay to try and short the market just because

the indicator is turning down -

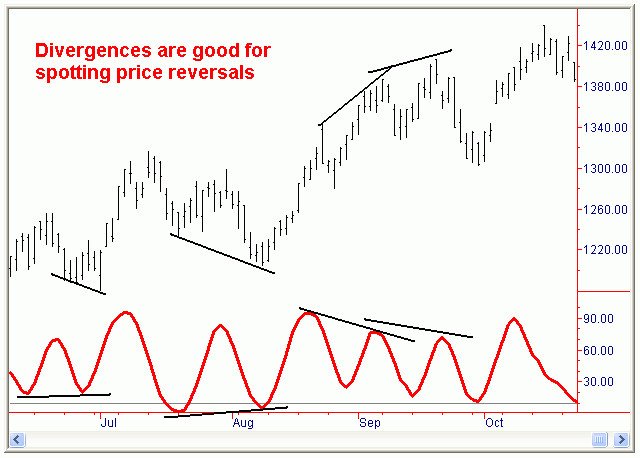

Divergences

It's also good when divergences form between the indicator and price. Below is the

same chart as before, only this time key divergences are noted between price and

the oscillator. Note that, in nearly each case an immediate reversal occurred in

the opposite direction. This makes it key to note: when price is making lower lows

or highs, but the oscillator is not confirming -

In my years of looking for indicators that turn quickly after cycle highs and lows

I think these have the optimum balance between ‘smoothness’ and the ability to turn

quickly. While there is no such thing as the 'holy grail', both the short and mid-

These indicators are for Tradestation only; you must be able to import an ELS file in order for the indicators to work.

Pricing:

You can purchase the Dominant Short and Mid-

Once payment is confirmed (through Pay-

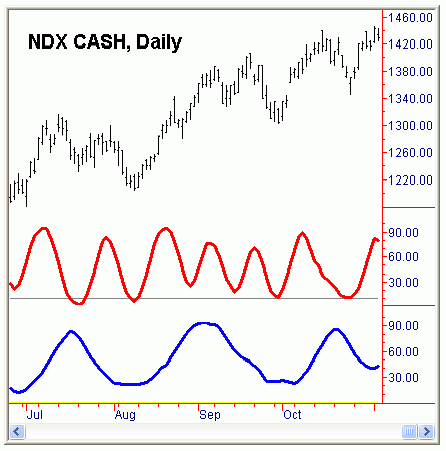

The chart below is a four-

The Dominant Short-